Hopefully, Elon Musk and his DOGE boys have learned a lesson the hard way. To wit, their earnest, dogged, sweeping and compelling demonstration early in 2025 that hundreds of billions can be cut from the Federal budget has already been shit-canned.

Almost in its entirety.

And by the usual suspects—-the GOP appropriators on Capitol Hill—who are the biggest fake fiscal conservatives to ever come down the pike.

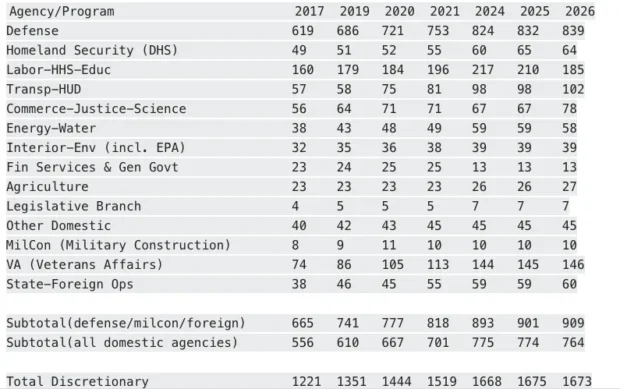

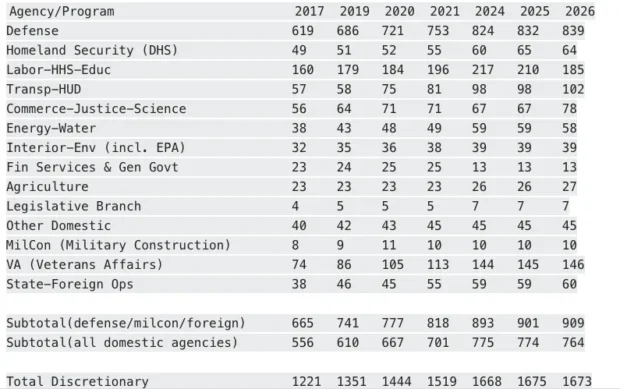

Still more proof in the pudding is contained in the table below, especially the bottom three lines. These show total discretionary appropriations contained in the House passed funding bills for FY 2026 compared to levels previously signed into law by alleged Big Spending Dems—-that is, Biden’s outgoing bills for FY 2024 and Obama’s for FY 2017.

Of course, to hear the GOP pols tell it on the campaign trail and during their table-pounding appearances on Fox News, Joe Biden was the biggest spending miscreant to ever occupy the Oval Office. He was ostensibly the very reason that America needed a Republican Congress.

Then again, the discretionary spending level in the House GOP-approved bills for FY 2026 is $1.673 trillion. That is actually $5 billion higher than the alleged runaway spending contained in the Biden-signed appropriations for FY 2024!

And the culprit isn’t just the War Party’s defense spending increases, either. As shown in the second line from the bottom of the table, the House GOP’s appropriation for all domestic spending agencies in FY 2026 amounted to $764 billion, which was 98.6% of Biden’s ultra-bloated 2024 level ($775 billion).

That’s right. In aggregate terms the House GOP embraced the sky-high Biden domestic spending levels virtually hook, line and sinker. Moreover, the FY 2024 Biden levels themselves had represented a 7.5% increase from the hideously bloated $721 billion pandemic bailout levels of FY 2021. The latter spending explosion, of course, had been the joint product of the two Trump pandemic bailouts enacted in March and December 2020 and another one known as the American Rescue Plan Act from the incoming Biden Administration enacted halfway through the fiscal year in March 2021.

This FY 2021 UniParty spending bacchanalia, in turn, had represented a ripping 30% rise from Obama’s last domestic agency funding level for FY 2017 ($556 billion).

That’s right. Even if you had granted a 2% increases per year for inflation, the FY 2026 appropriations for domestic agencies would have amounted to $664 billion in order to keep the Obama priorities in tact and hold the FY 2017 levels harmless for inflation. So what the screaming hypocrites of the House GOP appropriations committee have actually done is to fully fund an inflation allowance for Obama’s priorities and then jacked-up the domestic appropriations by another $100 billion, to boot!

And, yes, we do mean to blame each and every GOP member of the House Appropriations Committee for this outrage. That’s because it is bad enough that the GOP members outside the appropriations committee voted 157 to 22 in favor of Speaker Johnson’s egregious capitulation to the Washington Swamp.

But what is truly obscene is that the GOP appropriations committee members voted 34 to 0 in favor of 2026 domestic spending levels in the January 8th minibus that make an absolute mockery of the DOGE boys. Indeed, these bloated domestic spending levels belie every speech these cats ever made in behalf of fiscal sanity—especially when they voted “yea” on the budget-buster called OBBBA, and did so on the grounds that they would get around to spending cuts right soon after the July 2025 signing ceremony.

As is now clear from the table below, they had no intention whatsoever of actually cutting spending—even as they whooped it up for another massive increase in red ink. The Big Beautiful Bill will actually hurtle the Federal budget on a path toward an economy- and society-crushing $185 trillion public debt by mid century.

Discretionary Appropriations Spending, FY 2017 to FY 2026

The above pitiful display of GOP fiscal mendacity, however, is nothing new. We encountered it front and center back in the day when the so-called GOP appropriators time and again did a rug pull on Ronald Reagan’s repeated efforts to actually shrink the Leviathan on the Potomac. Indeed, he had barely rode off into the sunset in 1989 when virtually every discretionary spending program which had been reduced in the initial enthusiasm of the 1981 budget cutting campaign had been fully restored and then some.

Needless to say, the name plates on the GOP side of the dais in the Appropriations Committee hearing room in the Rayburn Building have mostly changed, but the modus operandi remains exactly the same. That is to say, there is a reason why the vote of the GOP appropriators was 34-0 in favor of this monstrosity.

To wit, we are referring to the infamous appropriations committee process known as log-rolling: You vote for mine; I vote for yours; and we all vote for the final bill—no matter how condemnable the total price tag.

Since this venal sell-out by the appropriators is at the heart of the GOP’s long-standing fiscal capitulation to the Washington Swamp, the clear patterns in its $100 billion add-on to Obama’s domestic priorities needs to be thoroughly explicated. So doing , we will show exactly how this fiscal crime is committed over and over again, year after year.

So we start with the Transportation/HUD (or THUD) bill shown in the table above, where the Obama funding level was $57 billion as of FY 2017. Had Big Spender Obama’s funding level been kept even with inflation at about 2% per year, the funding level for 2026 would have been about $68 billion.

Alas, the GOP appropriators voted unanimously for the above indicated level of $102 billion for FY 2026. That is, they fully funded the Obama budget at an inflation hold-harmless level— and then added a staggering +$34 billion or 50% on top of that!

You can’t make this up. That’s especially because most of this excess was for housing rental subsidies and aid for the homeless!

For crying out loud, the means-tested entitlements for low income households already cost upwards of $1.3 trillion per year. Yet these bald-faced hypocrites, who are always saying that the problem is “entitlements”, not “discretionary” appropriations, actually added 50% to the inflation-adjusted Obama level for these latter programs, and then voted as a block on the House floor for their own deplorable handiwork.

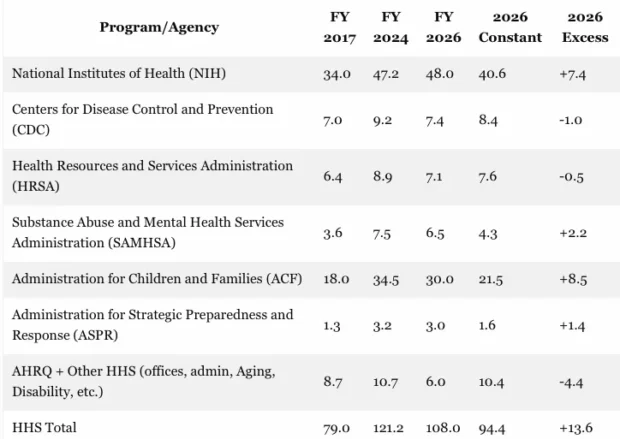

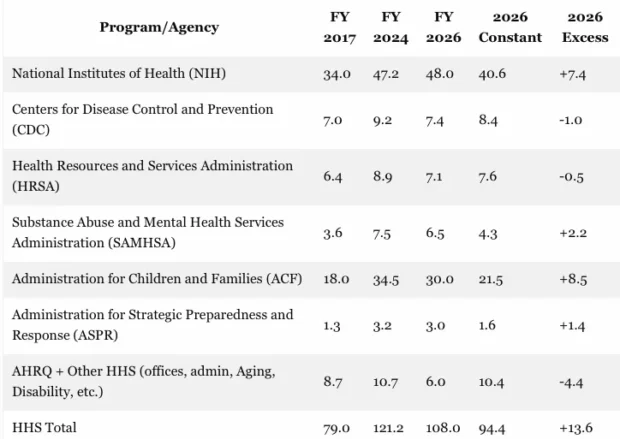

In the case of what amounts to the Democrat political homeland at HHS, the story is hardly better. The plentiful Obama FY 2017 level was $79 billion—and, again, this was just for annually appropriated discretionary programs. The massive HHS entitlement programs for Social Security, Medicare/Medicaid/ObamaCare, SSI, family assistance etc., which currently cost more than $3 trillion per year, are not included in the table below.

Accordingly, with a 2% annual inflation make-whole, the HHS discretionary programs would have merited an appropriation of about $94 billion in FY 2026— if your purpose was to maintain Obama level social welfare spending in constant dollar terms. Most surely that should not have been the GOP’s purpose at all.

But the purported GOP anti-spenders, however, actually did the Obama legacy one better: The actual figure in the their minibus for FY 2026 was 15% higher at $108 billion.

That’s right. At the very ground zero of the Dem Welfare State boondoggles, the GOP appropriators chipped in an extra $13.6 billion in Barry’s honor, apparently.

Moreover, half of that extra was owing to the runaway budgets of the National Institutes of Health. As it happens, every disease known to man has a lobby deeply embedded in the Washington Swamp. These lobbies take ownership of each and every member of the Appropriations Committee—whether such Members ordinarily vote in a leftward or rightward direction or just in favor of the highest bidder.

Still, our figure of $40.6 billion as the inflation-adjusted Obama NIH budget for 2026 isn’t actually the half of it. Again, back in the day the FY 1980 budget for the NIH we inherited from Jimmy Carter was $3.6 billion, and it was clear even then that the funding level was loaded with fat, which we attempted to trim albeit to very little avail.

Yet had the Jimmy Carter budget for NIH been increased for inflation each and every year since then it would actually be $12 billion today, not our $40.6 billion keep-whole figure or most certainly not the GOP appropriators’ $48 billion. In a word, these fiscal fakers have authorized four times morefunding than would have been required to hold Jimmy Carter’s NIH budget harmless for inflation over the last 46 years!

Of course, it might be wondered whether there is a single Republican on the Appropriations Committee who has ever given any thought at all as to why the US government should be funding anything beyond basic science in the first place. As it is, the nearly $50 billion shoveled out through the NIH goes overwhelmingly for applied research, product development and proto-commercialization—measures which inure to the benefit of the fat and happy government-fed health care industry.

Indeed, have they ever wondered why the NIH breeds bureaucratic cretins the likes of Dr. Fauci?

No, rather than do their job as watchdogs of the Treasury, the GOP pols appointed to the Appropriations Committee end up functioning as concierges for the disease lobbies and the plenitude of other special interests who Fed at the Federal trough.

HHS Discretionary Spending, 2017 to 2026

Notes:

- Figures are base discretionary BA (excluding mandatory/trust fund and supplemental/emergencies).

- FY 2017: From CRS R44070 and OMB Historical Tables.

- FY 2024: From enacted P.L. 118-47 and House Appropriations summaries.

- FY 2026: From House-passed H.R. 9027/minibus summaries (annualized; pending Senate and final enactment).

- 2026 Constant = FY 2017 × (1.02)^9 ≈ FY 2017 × 1.195.

Needless to say, these kinds of pork barrels come in all sizes, shapes and budgetary domains. Thus, the Energy and Water bill for 2026 also contains funding way above the Obama level adjusted for inflation, providing 30% more or nearly +$14 billion of additional funding.

Again, the Federal government has no business using taxpayer funds or, worse still, borrowing money, to fund local river navigation improvements, flood plain control and energy R&D projects. Those are properly the business of private enterprise, local government or, at the least, should be funded 100% by user fees.

But when it comes to the pork barrel, it is a truism that energy subsidies and water projects grease the political wheels with alacrity on the banks of the Potomac. Indeed, we learned that early on as a freshman Congressman in 1977, when we got called to the White House by Jimmy Carter. In this case, he was actually trying to cut spending for egregiously wasteful and corrupt water projects, but was so desperate for any GOP support at all that he had to call upon a first termer for help on Capitol Hill.

The truth is, virtually none of the $59 billion appropriated for 2026 can be justified in the face of a $38 trillion public debt that is rapidly rising skyward. Indeed, even the $20 billion for the DOE nuclear programs could be readily squeezed out of the massive fat in the Pentagon budget.

But have the GOP appropriators ever even thought about actually defunding the DOE, the Army Corps of Engineers and the Bureau of Reclamation? With their noses firmly implanted in the trough, we are quite sure the thought has never even crossed their minds.

Discretionary Appropriations For Energy And Water, 2017-2026

In the case of the $30.4 billion FY 2026 funding for the Agriculture bill, it can be at least said that this level is about equal to the Obama FY 2017 budget adjusted for inflation. But here’s the thing: More than 90% of this total shouldn’t even be funded.

To wit, the food inspection, FDA and other regulatory operations should be funded by user fees or drastically reduced in scope. Likewise, ag research, rural development and the Forest Service should be largely privatized.

Then again, farm state Republicans get on the Appropriations Committee and the relevant subcommittees precisely to insure no free market Republican or libertarian bomb-thrower even gets in the vicinity of the Appropriations Committee hearing room. After all, the idea of defunding this entire trough of pork might sound exactly like there own speeches in favor of free enterprise and fiscal rectitude back on the campaign trail.

Discrimination Funding In The Agriculture Bill, 2017 to 2026

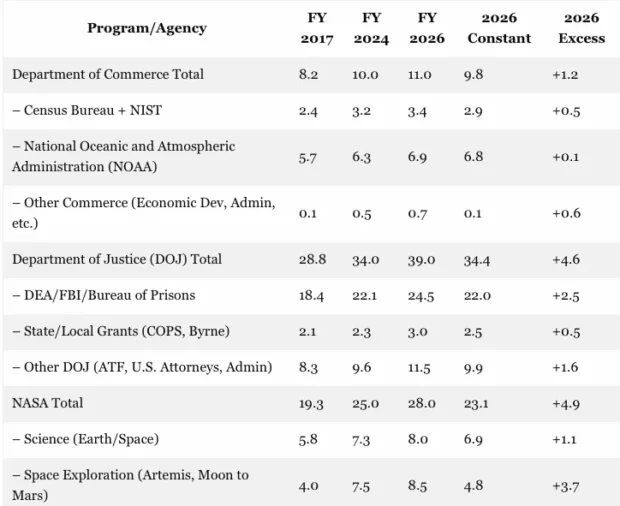

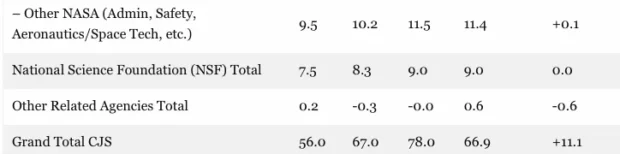

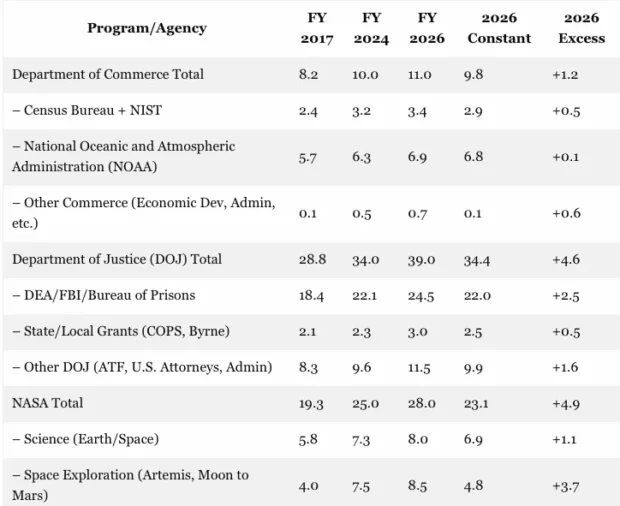

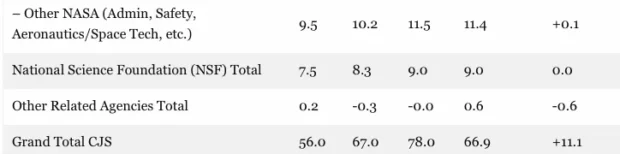

The same can surely be said for the $78 billion provided for FY 2026 in the Commerce/Justice Science bill. Again, this represent a 16% or $11 billion increase to the Obama levels in real terms, but that’s not even the half of it.

To wit, in a world of small, decentralized, solvent government upwards of $60 billion or 80% of this amount could actually be cut from the proposed 2026 figure. And that could start with eliminating the entire $28 billion appropriation for NASA.

If space launches have a military purpose, they should be funded by the Pentagon. If they have a commercial purpose like some of the Space X ventures, they should be funded by the private sector and satellite users. And if they are for the thrill and adventure of exploring the universe they should be funded by private space buffs—-from Elon Musk to the guy with a backyard telescope.

To the contrary, NASA never has been a legitimate government project, even when it sent a man to the moon in 1969 at massive taxpayer expense, and then forgot all about it for the next 55 years. The moon-landing was always a silly national vanity project that Washington fell for in the early 1960s because we didn’t get a dog, and then a man, up in low earth orbit before the Ruuskies did. That is, before a communist system that was destined to fail could waste more money than Washington could.

The same goes for the Commerce Department’s $11.0 billion appropriation. NOAA should be funded by users who actually are willing to pay for weather reports and atmospheric research or not be done at all. Ditto for most of the $9 billion appropriated to the National Science Foundation: Cut it back to basic science and let the rest find a home in the private sector, if there is one.

Even in the case of the $39 billion appropriated to DOJ, the overwhelming share ($25.4 billion) goes to the FBI/DEA and Bureau of Prisons. The fact is, the War on Drugs is a grotesque failure–so the DEA should be defunded and abolished.

Likewise, enforcement of the criminal laws in our constitutionally ordained Federalist system is overwhelmingly a proper function for the 86,000 units of state, county, city, village and township government in the US. The FBI’s $12 billion budget and 35,000 headcount could be cut by 80%, and law and order in the America would be no worse for the wear.

To the contrary, it would actually result in far less false flag spooking of the public by the FBI’s endless entrapment operations designed to create the illusion that America is being over-run by terrorists and foreign agents.

And as for the Bureau of Prison (BOP), get rid of the drug prohibition prisoners, others prosecuted for so-called morality crimes and white collar offenses and most of the inmates nabbed in phony counter-terrorist operations. You then wouldn’t need 80% of the cells and most of the BOP’s $10 billion budget.

Commerce/Justice/Science Appropriations, FY 2017 to FY 2026

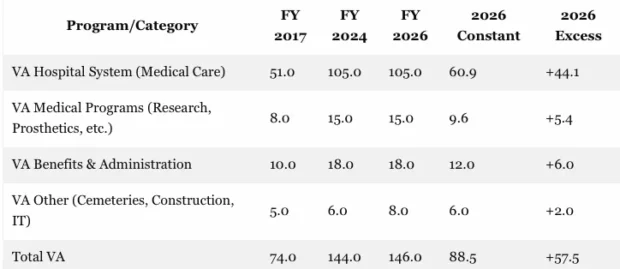

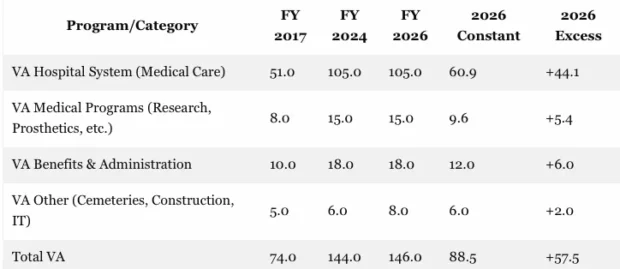

Finally, we have the real elephant in the room. We are referring to Obama’s $74 billion 2017 budget for discretionary Veterans Administration (VA) programs, which would be nearly $89 billion in FY 2026 if it had been fully funded for inflation.

Alas, the GOP appropriators provided $146 billion for FY 2026 or $58 billion more than the inflation-adjusted Obama budget. So you might think that there has been a flood of new VA beneficiaries since 2017, but you’d be wrong.

What we actually have is the travesty of 17 million veterans of the totally unnecessary Forever Wars (there are only a few thousand WWII vets left) who are eligible for the full range of health and mental health benefits, but which are delivered by a government bureaucracy that gives the very idea of waste, excess, feather-bedding and grotesque inefficiency a wholly new definition.

For instance, there are 70,000 beds in the VA hospital system that are normally 65% to 70% occupied, meaning an average census of about 49,000 patients. But the VA hospital system has 295,000 employees, which amounts to more than six VA staff for every patient!

So were the VA hospital systems employees to all be put into occupied rooms, there would literally be standing room only.

Likewise, in the case of the VA benefits administration the overhead cost of $18 billion amounts to 2.3% of compensation and pension benefits paid. That’s an admin cost ratio which is 3X higher than the Social Security Administration’s o.7% ratio, which is no paragon of efficiency, either.

The larger point is that the GOP appropriators are wholly-controlled water-boys for the various veterans organizations and their powerful beltway lobbies. Consequently, the screaming fiscal disgrace of the $146 billion VA budget is directly attributable to GOP appropriators who have never been interested in the slightest in bringing this budgetary monster to heel.

Veterans Administration Discretionary Spending, FY 2017 t0 FY 2026

Notes:

- VA Hospital System (Medical Care): Primarily the Veterans Health Administration’s medical care account (direct hospital and outpatient services).

- VA Medical Programs: Includes medical research, prosthetics, medical facilities support, and related medical R&D.

- VA Benefits & Administration: Covers compensation/pension, education, vocational rehab, and administrative costs for benefits delivery.

- VA Other: Includes national cemeteries, construction, IT systems, and general administration.

- FY 2017: From CRS R44070 and OMB Historical Tables.

- FY 2024: From enacted P.L. 118-47 and House Appropriations summaries.

- FY 2026: From House-passed minibus summaries (annualized; pending Senate and final enactment).

- 2026 Constant = FY 2017 × (1.02)^9 ≈ FY 2017 × 1.195.

Indeed, if there were ever an agency that needed a DOGE-style housecleaning, it is surely the VA. But in Clint Eastwood style, as it were, the GOP appropriators have already pronounced their perennial verdict: Don’t even think about it!

Finally, we would be remiss if we did not conclude this review with the names of the 34 GOP miscreants who produced this condemnable monstrosity. So here they are—-every last one of the names truly fit for the Wall of Fiscal Shame.

Elon Musk and the DOGE boys gave them a road map on how to save the hundreds of billions that all along they have been too lazy and too compromised to find. But 12 months later there is not even a teeny-tiny sign in the FY 2026 funding bills that the DOGE boys ever came to town.

Appropriations Committee Republicans (34 members, including Chair Tom Cole (R-OK), Hal Rogers (R-KY), Robert Aderholt (R-AL), Michael Simpson (ID), John Carter (TX), Ken Calvert (CA), Mario Diaz-Balart (FL), Steve Womack (AR), Chuck Fleischmann (TN), David Joyce (OH), Andy Harris (MD), Mark Amodei (NV), Dave Valadao (CA), Dan Newhouse (WA), John Rutherford (FL), Julia Letlow (LA), Guy Reschenthaler (PA), Ashley Hinson (IA), Tony Gonzales (TX), Ben Cline (VA), Scott Franklin (FL), Jake Ellzey (TX), Juan Ciscomani (AZ), Michael Guest (MS), Andrew Clyde (GA), Jake LaTurner (KS), Jerry Carl (AL), Stephanie Bice (OK), Dusty Johnson (SD), Amata Coleman Radewagen (AS), Mark Alford (MO), Nick LaLota (NY), Dale Strong (AL), Celeste Maloy (UT), Riley Moore (WV)): 34 Yea, 0 Nay.

Reprinted with permission from David Stockman’s Contra Corner.