TMM (Trump’s Macho Madness)

January 7, 2026

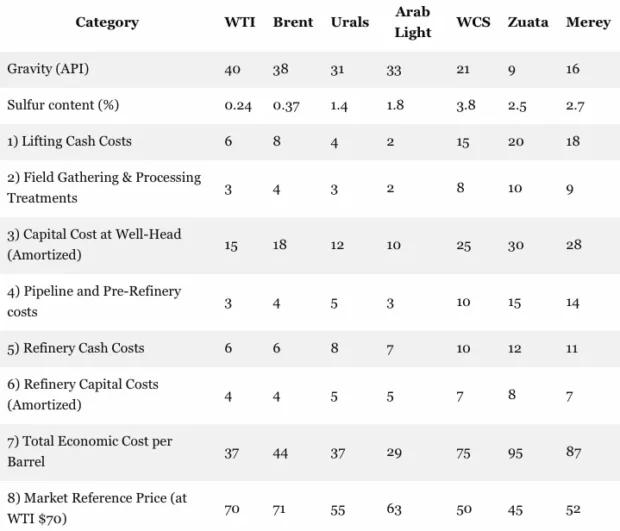

Until the Donald came along, Nixon’s feckless War on Drugs was surely among the stupidest projects of state ever conceived on the banks of the Potomac. As we show in detail below, Washington’s writ criminalizing cocaine raises the street price from about $1,000 per pound based on the pure economics of farming, processing and distribution to an actual street price for today’s contraband cocaine of about $54,000 per pound.

That’s right. Washington’s idiotic drug war generates an excess margin of $53,000 per pound of white powder owing to artificial scarcity and supply losses from law enforcement interdiction. These corpulent margins, in turn, are available to fund the most vicious and profitable black market criminal supply chains known to man. The resulting violent enterprises literally flood the zones from the cocoa farms of Columbia to the “dime bag” pushers in Columbus Circle (New York) and all the cartels, drug lords and thugs in-between with a cornucopia of money.

In gross dollar terms, in fact, the 635,000 pounds of cocaine that makes its way toward street level users in the US each year generates about $35 billion (at $53,000 per pound of excess margin) worth of funding for criminal enterprises-–compliments of Uncle Sam and the foolish legislators who perpetuate and fund Nixon’s greatest folly.

Of course, the “public health” rationale for this prodigious level of government subsidization of crime is that cocaine used in excess can be harmful. Well, yes, the annual fatality rate among users is about 0.1% ( see below). As it happens, however, that’s the same as the 0.1% fatality rate for alcohol users, while it’s actually below the 0.2% fatality rate for active hang-glide pilots and far, far below the 1.7% annual death rate for tobacco smokers. And, of course, all of the latter (hazardous) pursuits are fully legal.

So apart from the core principle that in a free society adults ought to be able to choose whatever form of stimulant and recreation they prefer (so long as it does not harm others), the War on Cocaine is batshit stupid because the amount of actual harm it reduces is hardly even measurable. And most especially it is mind-numbingly insane relative to the immense and very tangible levels of crime, mayhem and death to innocent bystanders that results from what amounts to a government-induced $35 billion annual bounty for violent criminal activity just in the case of cocaine alone.

Needless to say, the Donald is apparently not to be outdone by Tricky Dick in the stupidity department. The stated purpose of his invasion of Venezuela during the wee hours on Saturday and the kidnapping of its pajama-clad president was the latter’s alleged violation of America anti-cocaine laws.

As to when, in the first place, Washington was seconded by god or the UN the right to impose and enforce its dubious domestic prohibition laws on the sovereign territory of other nations, our teetotaling president did not say.

But in this context we did say “anti-cocaine laws” rather than drug laws generally for a good reason. Consult the DEA, FBI and any other law enforcement authority that you choose, and you will find they have proffered no evidence whatsoever that any living soul in Venezuela, let alone its president and his wife, have ever had any role in the supply of fentanyl, heroin, meth or even marijuana to the US.

So the Donald has started an illegal and unauthorized war to deny an estimated 5 million US adult cocaine users access to any Venezuela-based supplies of a recreational drug that—

- has a mere 0.1% chance of killing them.

- will not make a damn bit of difference as to supply and availability on the streets in the US anyway. That’s because Venezuela supplies just 8% or 51,000 pounds of the total US cocaine supply of 635,000 pounds annually.

Moreover, almost the entirety of this tiny amount of Venezuela-based cocaine is actually grown, harvested and processed into bricks in Columbia. The fact is, finished product merely passes through trans-shipment routes in Venezuela, which could be replaced by alternative routes in a heartbeat.

Indeed, the DEA says that Columbia supplies 84-93% or upwards of 600,000 pounds of the total gross supply into the US. So if the Donald were even half-assed serious about the drug pretext for invading a Latin American neighbor, we’d guess he kidnapped the wrong man!

That is, you’d think that he would have sent the helicopters and Delta Force to Bogota in order to nab Columbia president Gustavo Pedro for the performative perp ride he arranged for live TV to motor a foreign “bad guy” to the Brooklyn correctional facility. If there were such a thing as a Narco-Terrorist-State, which there isn’t since its a made-up phrase emanating from the bowels of the Washington War Machine’s PR (i.e. lie) department, Bogota, not Caracas, would surely be its capital city.

In sum, nobody in Venezuela sent any “poison” to America. Period. Full Stop. The whole Narco-Terrorist-State pretext for the invasion is just flat-out hogwash.

Actually, when you dig into it you find the same is true with respect to the “blood for oil” blather that has at least begun to bring the left-wing rent-a-protest echelons to the streets in a goodly number of US cities. But this canard also needs to be knocked on its ass because even on his side of the ledger the Donald actually thinks Venezuelan oil at one and the same time is going to pay the billions that his invasion and occupation of Venezuela will ultimately cost—as well as return riches to America and Make Venezuela Great Again (MVGA), to boot.

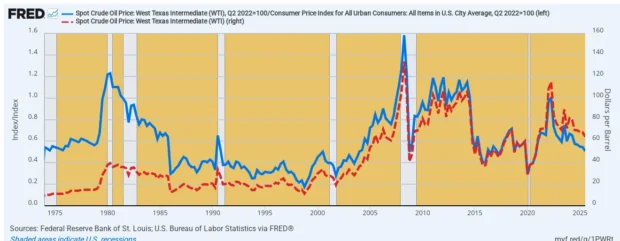

No, there is not a snowball’s chance in the hot place the Venezuela’s alleged world-leading 303 billion barrels of oil reserves will do anything of the kind. That’s because anyone with a passing knowledge of the global petroleum industry knows that not all oil reserves are created even remotely equal; and, to the contrary, that there is a steep supply curve in terms of extraction, processing and conversion costs to get reservoir hydrocarbons to end stage usable petroleum fuels.

This supply curve ranges from $30 per barrel for light sweet crude oil (i.e. West Texas Intermediate or WTI) to upwards of $100 per barrel for Venezuela’s Zuata, Merey and BCF-17 heavy oil based grades. Accordingly, at the present time with global market crude oils at $70 per barrel, and recently well below that level, the two leading Venezuela grades generate implied economic losses of $35 to $50 per barrel.

You might be inclined to say, holy moly! Say again?

Well, upwards of 95% of Venezuela’s vaunted oil reserves are comprised of heavy, extremely viscous crude oils (line 1) that also have high sulfur content (line 2) relative to the benchmark WTI. These low gravity/high sulfur characteristics sharply increase field production costs, as well as generate far higher refinery operating and capital costs for SO2 removal and the extra processing and hydro-treating required to breakdown the hydrocarbon chains of these heavy crude oil inputs and thereby generate the finished product slates of distillates, gasoline and jet fuels demanded in the petroleum product markets.

For instance, according to Grok 4’s survey of the industry data, it costs about $24 per barrel to get WTI from the reservoir to the wellhead pipeline or trucking connections, another $3 for transportation to the refinery and then a further $10 for refinery operating (cash) and capital costs. Accordingly, the total cost per barrel of the standard delivered product slate amounts to an estimated $37 per barrel for WTI.

In turn, that means at a recent typical market price for WTI of $70 per barrel, the fully-costed economic profit on a vertically integrated basis is a fulsome $33 per barrel. Even then the return on capital is modest given the massive amounts of investment needed to bring hydrocarbons out of their deep earth (often fracked) reservoirs and to market as usable refined products

Likewise, for the equally high quality Saudi Light, production costs per barrel are even lower at $29 per barrel (line 7). But after a $7 per barrel discount for transportation from the Persian Gulf to Amsterdam, New York or the Far East, the netback value is about $63 per barrel (line 9), thereby generating a vertical economic profit of $34 per barrel.

It goes without saying, therefore, that when the global marker crude is at its recent steady state level of about $70 per barrel, you quickly reach the point on the supply curve where all-in economic profits disappear and production stays up only because some producers choose to sell oil at a cash profit—even if amortized capital costs are not recovered in the short run.

For instance, the column for West Canada heavy oils (WCS) shows that the full economic cost of production is $75 per barrel. But due to pipeline distance from the US refineries and an inferior product slate owing to the low gravity levels of its heavy crude, there is a $20 per barrel discount on the netback to the wellhead relative to WTI at $70. So the implied economic profit or loss is a -$25 per barrel; and even when you ignore capital cost amortization at both the field and refinery level, the cash profit is a thin +$7 per barrel.

Needless to say, when you move even further down the quality curve to the gunky 9-16 degree gravity oils represented by Venezuela’s ultra-heavy crudes from the Orinoco belt, such as the Zuata and Merey heavy grades, the cost goes even higher and the discount for the lower value product slate gets even steeper. Thus, for the Zuata grade, which accounts for more than 70% of Venezuela’s reserves, the total economic cost of production is $95 per barrel because lifting, conversion and refining processes are far more energy and capital intensive than for WTI and other lighter, sweeter crude oils.

At the same time, the quality discount to the WTI benchmark price is $25 per crude barrelequivalent owing to a much higher ratio of low-value bunker fuels, coke and other heavy products contained in the refinery yield. Consequently, at $70 per barrel for WTI marker prices, Venezuela’s Zuata crude oil looses a staggering $50 per barrel on a full economic cost basis and $12 per barrel even on a cash basis.

So here’s some news for the Donald and the various elements of the rightwing commentariat who have jumped aboard the Venezuela Liberation train. The country’s oil industry is in the shitter not mainly due to socialism (although the Chavistas have robbed the national oil company blind) but actually owing to capitalism!

That’s right. Most of the time global petroleum supply markets have generated more than enough crude oil from locations and resources bases positioned lower on the cost curve than Venezuela’s ultra heavy crude oils, meaning that most of the time over the course of the global crude oil pricing cycle Venezuelan heavy oil is unprofitable. In short, the decrepit state of Venezuela’s petroleum industry is far more the handiwork of Mr. Market than it has been the result of socialist tinkering by Messrs. Maduro and Chavez.

What this means is that the Donald and the rightwing commentariat cheer-leading his body snatching gambit with Maduro are just plain out to lunch. Unless crude oil prices have another breakout to the $125 to $150 per barrel range and remain at those levels, there will be no Venezuelan oil to profitably sell in order to recover the billions that it will cost the US Treasury to “run” the country over the next several years. And that’s to say nothing of the Donald’s chimerical claim that tens of billions will come streaming back to the US in compensation for the 2007 nationalization of the country’s heavy oil industry.

Cost Comparison: Major Global Crude Oils ($/bbl)

Footnotes:

- Gravity and Sulfur values use midpoint of standard range where applicable.

- 1-6: Direct operating and amortized capital costs (cash + capex elements).

- 7: Full-cycle total cost (including amortized capex).

- 8: Typical realized price when WTI is $70/bbl (e.g., Brent small premium; heavies/sours discounted $10-25/bbl). Notional averages; actuals fluctuate with markets/sanctions.

- 9: Economic profit/loss = Market Price – Total Cost (covers cash costs + amortized capex).

- 10: Cash profit/loss = Market Price – Cash Costs only (lines 1,2,4,5; excludes amortized capex in lines 3 & 6). Positive for light/sweet crudes; negative or marginal for heavies even on cash basis at $70 WTI.

- Merey added as the primary export blend (more important by production/export volume). Costs interpolated between heavy (WCS) and extra-heavy (Zuata). All figures notional; vary with tech/markets.

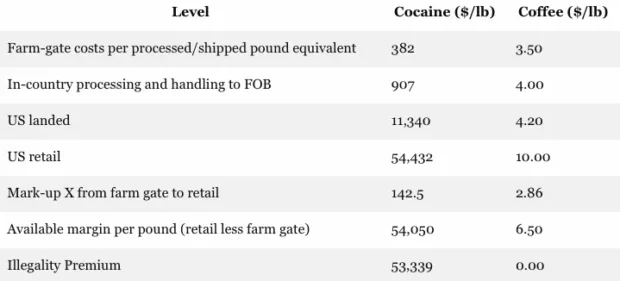

For want of doubt that Venezuela’s 303 billion barrels of most heavy crude reserves are no economic gold mine, consider the 50-year history of the benchmark crude oil (WTI) since the mid-1970s. That covers the span after much of the industry was nationalized in the 1970s under the national oil company (PDVSA)—an event that occurred long before the Chavez socialist government’s final expropriation in 2007.

Given the $25 per barrel quality discount for Venezuelan heavy crude oils, it would take a $115 per barrel WTI reference price in the global markets to generate an economic profit on the country’s most abundant reserves—-the Zuata ultra-heavy. Yet as shown by the dashed red line in the chart, the WTI price has been above $115 per barrel rarely during the last half century; and, in fact, it last hit $115 per barrel briefly in Q2 2022 when the overall US inflation rate was soaring to its 40-year high of nearly 10% per annum.

To be sure, there has been a lot of cumulative inflation since the early 1970s. So in the blue line we index the WTI price to the recent Q2 2022 CPI peak of $115 per barrel, which is set at 1.0 on the left hand scale.

So doing, the graph poses a simple test: Only when the blue line index (left axis) was above 1.0 during the last 50 years would Venezuela’s preponderant reserves of heavy oils from the Orinoco belt have been profitable on an all-in economic basis. That is to say, only then would they have generated a positive return on the massive amounts of capital needed to turn viscous hydrocarbon gunk into a standard slate of refined fuels.

The graph doesn’t lie. The Venezuela heavy oil industry is in shambles because it hasn’t been producing any return on capital since 2014; and, in fact, it would have been unprofitable 85% of the time since 1974, anyway.

So much for the Donald’s brazen hostage-taking. Unless oil prices permanently soar toward $125 to $150 per barrel in real terms for the indefinite future, he’s gotten himself and America a real lemon. That is, if he can keep it, which seems highly unlikely.

50-Year History Of the WTI Benchmark Crude Oil Price, Nominal (red dash) and Inflation-Adjusted (Blue Line)

So we needs go back to square one: If the reason for the Donald’s invasion and body-snatching is stealing Venezuela’s prodigious reserves of heavy oils, it is sure to be a grave failure for many years to come. And that’s to say nothing of the fact that it amounts to a just another episode of “regime change” or the very thing that he promised the MAGA faithful was at the top of his agenda to end.

And for crying out loud. Can we dispense with any notion that Venezuela is a military threat to the $1 trillion per year military budget monster of the USA? After all, they snatched Maduro and his wife out of the equivalent of the Lincoln Bedroom in the White House without a single gunshot wound or grazed forearm among the Delta forces that ambled into the presidential residence in Caracas.

The fact is, Venezuela is a military nothingburger. Its defense budget for 2025 is approximately $4.1 billion, which amounts to only about 0.6% of its GDP and is the equivalent of about 35 hours per year of Pentagon spending.

This laughably limited funding has contributed to chronic under-maintenance and obsolescence across its armed forces. The total personnel in the Venezuelan armed forces stands at barely 109,000 active-duty members, with readiness and training levels reportedly low due to economic constraints and sanctions.

In terms of air power, Venezuela’s inventory is dominated by aging Soviet-era and Russian-supplied aircraft, with the most capable being 11-12 operational Su-30MK2 multi-role fighters (out of 24 originally acquired), which have some air-to-air and air-to-ground capabilities, though hampered by endemic spare parts shortages. Even older assets include a handful of aging F-16s (3-4 operational) from the 1980s U.S. supply, but these are restricted and outdated.

The missile force is primarily defensive in nature, focused on air defense and short-to-medium-range systems—meaning it has not even the remotest capacity to strike US targets. Key assets include the S-300VM surface-to-air missile system (range up to 200 km with limited anti-ballistic roles), Buk-M2 medium-range SAMs, and BM-30 Smerch rocket artillery, but these are all tactical and coastal-defense oriented. Overall, Venezuela’s military capacity is minimal, defensive, under-maintained, short of spare parts and reliant upon cold war era equipment from both sides that is no longer a threat to anyone.

In short, the Donald gets the Richard Nixon booby prize for attempting to extending a War on Drugs that could never be won in the first place because it defies the law of markets. Still, the utterly over-the-top rhetoric on which this faux war against the chimera of a Narco-Terrorist State is being prosecuted needs be reduced to the inanity on which it is based.

We are referring here the bombastic rhetoric of Secy Hegseth and Ice Barbie at the Homeland Security Department. The latter had this to say the other day while planting her lips upon the Donald’s ample posterior:

“You’ve saved hundreds of millions of lives with the cocaine you’ve blown up in the Caribbean.”

OK, that’s just unadulterated bullshit. That is to say, last year there were 178 million alcohol drinkers in the US, which, unfortunately, resulted in 178,000 alcohol related deaths. That’s a regrettable 0.1%fatality rate among booze users.

But to remind, alcohol isn’t illegal because America hasn’t yet forgotten the bitter lessons of the Prohibition disaster 100 years ago.

By contrast, the only illegal drug that comes in from Venezuela is the aforementioned tiny share of the nation’s cocaine supply.

So the “killer” drug the Donald, Ice Barbie, Hegseth and the rest are gumming about is cocaine. Yet even then, as previously menti0ned, Venezuela grows zero percent of the annual US supply of about 635,000 pounds, and accounts for only 8% of US bound shipments via transit from Columbia and other sources.

Still, cocaine may well be both illegal and a dubious source of recreational stimulants for most people, but it is actually no more deadly than alcohol. To wit, according to DEA and other government agencies, last year there were about 5 million cocaine users in the USA and about 5,000 deaths from pure cocaine overdoses.

In this regard, the higher figure of 20,000 cocaine deaths per year often cited by drug prohibitionists reflects the widespread spiking of street cocaine with deadly fentanyl. The latter is far, far cheaper at 0.3 cents per dose versus versus $150 per dose for cocaine or more than 1,000X more.

So it is not surprising that the vicious criminals subsidized by Washingtonian’s idiotic War on Drugs resort to spiking their cocaine sales with vastly cheaper fentanyl—even if they do periodically winnow-down the size of their customer base.

In any event, notwithstanding the fatality rate among cocaine users purely from cocaine at just 0.1%, Nixon’s long-running misbegotten War on Drugs was still spending billions each year trying to eradicate it. But now the Donald has taken this pointless project in hand, using $40 billion carrier battle groups to blow-up cocaine-transiting speed boats, capped off by kidnapping the president of a country that supplies ridiculously small amounts of it. This is simply the stupidest, most irrational action ever conceived on the banks of the Potomac, and there is surely plenty of competition for that honor.

The reason is straight forward: Namely, interdiction and destruction of supply only drives up the price and drastically so—thereby, as we have indicated, making the illicit business of growing, shipping and distributing cocaine all the more profitable. In turn, this also means that the illegal cartels which distribute it are capable of spending whatever it takes to counter-act law enforcement and to compensate for the loss of product due to interdiction. Stated differently, the idiots behind Prohibition—from alcohol to cocaine and heroin—-believe that they can win by defying the market law of supply and demand.

They most surely cannot. The only thing supply destruction actually accomplishes is to massively increase the revenue of the drug cartels and their ability to maintain ever larger armies of ever more violent operatives to conduct their insanely profitable businesses.

For want of doubt, let’s begin with the basic facts of supply and demand. Currently, Grok 4 indicates that US cocaine consumption is estimated at 500,000 pounds per year. Among an estimated 5.0 million active users, that’s an average annual consumption of 2 ounces per user per year. That is to say, the overwhelming number of recreational users are not about to kill themselves on 2 ounces of snort.

Nevertheless, the actual supply of cocaine coming into the USA in 2024 was about 635,000 pounds, meaning that about 135,000 pounds of seizures by the Coast Guard, other border control operations and law enforcement domestically amount to nearly 30% of actual use.

Yes, for a product with the inherent high price inelasticity of a recreational stimulant like cocaine, just have the cops confiscate 30% of end demand. That do make the price go sky-high!

And that gets us to the absurd economics of the so-called War on Drugs—even before the Donald mobilized the $1 trillion Pentagon budget and even before the Donald went bat-shit this past weekend. That is, we were talking about using hundreds of thousands of domestic law enforcement personal led by the DEA, thousands of Coast Guard and other border patrol to hunt down 135,000 pounds of a drug that is no more lethal than alcohol!

After all, the US governments at all levels spends an estimated $100 billion per year on the War on Drugs. So even if just 20% of that is directly against the cocaine traffic, that’s nearly $150,000 per pound of cocaine interdicted!

That’s surely stupid enough, but it’s not even the half of it. Spending that much on policing, interdiction and supply destruction drives the price skyward. As shown below, the farm-gate value of cocaine paste grown in Columbia is just $382 per pound, which rises by another $525 per pound for in-country processing and delivery to shipping points, but then the cost of interdiction takes off like a bat out of hell.

The landed value in the US is estimated by Grok 4 at about $11,320 per pound. However, the shipping cost of the 635,000 pounds that makes it way to the US is not remotely the $10,340 per pound uplift from the port of export value. That 10X mark-up is plain and simple the high cost of combating law enforcement and compensating for the 30% of supplies that are lost due to interdiction on the way to end customers.

Beyond that, as also shown by the table, there is another nearly 5X mark-up on the way from illegal entry at the US border to street value at retail. Needless to say, the standard ratio of landed-price to retail for normal, legal commerce is 2X, as exemplified by the case of coffee in the second column.

In all, the mark up from the Columbia farm-gate to retail is 142.5X or $54,050 per pound of product distributed at retail. By contrast, coffee beans grown in Columbia and distributed via legal commerce exhibit a mark-up of just 2.86X between farm gate and retail value per pound.

Moreover, the only reason the farm-gate value of cocaine is more than 100X higher than that of coffee beans is that it takes about 500X more land to generate enough cocaine leaf for a pound of paste as it takes to grow enough coffee cherries for a pound of brew.

Accordingly, were cocaine commerce to be legal and were the leaf-based paste produced at the farm level at $382 per pound to be handled by legal shipping lines and domestic drug store distributors, the street retail value at the coffee mark-up rate would be about $1,100 per pound or 98% less than current levels. Stated differently, the prohibition cost amounts to more than $53,000 per pound.

Stated differently, what does that $53,000 per pound cost of law enforcement and prohibition in the retail price of coke really fund?

Well, violent criminal syndicates. That’s what!

And yet and yet. The Donald is compounding the insanity by starting a war against a neighboring country that poses absolutely zero threat to the Homeland Security of America.

So the question surely recurs. Who would authorize something that insensible and stupid?

Simple: The current Oval Office occupant who at 79-years of age apparently needs to prove that he is a Macho Man who can still get it up.

Supply Chain Cost Of Columbia-Produced Cocaine Versus Coffee

Reprinted with permission from David Stockman’s Contra Corner.

Copyright © David Stockman

Former Congressman David A. Stockman was Reagan's OMB director, which he wrote about in his best-selling book, The Triumph of Politics. His latest books are The Great Deformation: The Corruption of Capitalism in America and Peak Trump: The Undrainable Swamp And The Fantasy Of MAGA. He's the editor and publisher of the new David Stockman's Contra Corner. He was an original partner in the Blackstone Group, and reads LRC the first thing every morning.

No comments:

Post a Comment